CMG’s work with business families enables us to witness what makes these families – and their businesses – continue to grow, overcome obstacles, and stand the test of time by playing the long game. Every family’s story is different. It makes each inspiring in their own way.

It’s why we continue to research how the top families sustain their success. One story in particular – this one from Forbes about a family in Arkansas – grabbed our attention with the very first sentence:

“The secretive clan behind the Dillard’s department store chain has a reputation for avoiding reporters, refusing to hold earnings calls and dodging investor queries about their results. So low-profile and seemingly unambitious with respect to their peers, they are sometimes called ‘the Dullards.’ But there is nothing dull about the family fortune, which is suddenly being measured in billions – not millions – as shares in their 83-year-old department store business skyrocketed over 300% this year, making it one of the best-performing stocks of 2021.”

That opening hooked our interest, so we dug deeper into the Dillards. We discovered the family’s commitment to playing the long game exemplifies its foundation of success through three generations of family leadership – while maintaining their values. It began with its founder, William Dillard, who took a long-term view in building his retail business. Rather than focusing on fast gains and quick wins, William instilled values of hard work, integrity, education, conservative financial philosophy, social responsibility, and family importance in his children. He believed these values would build a successful life and a thriving business.

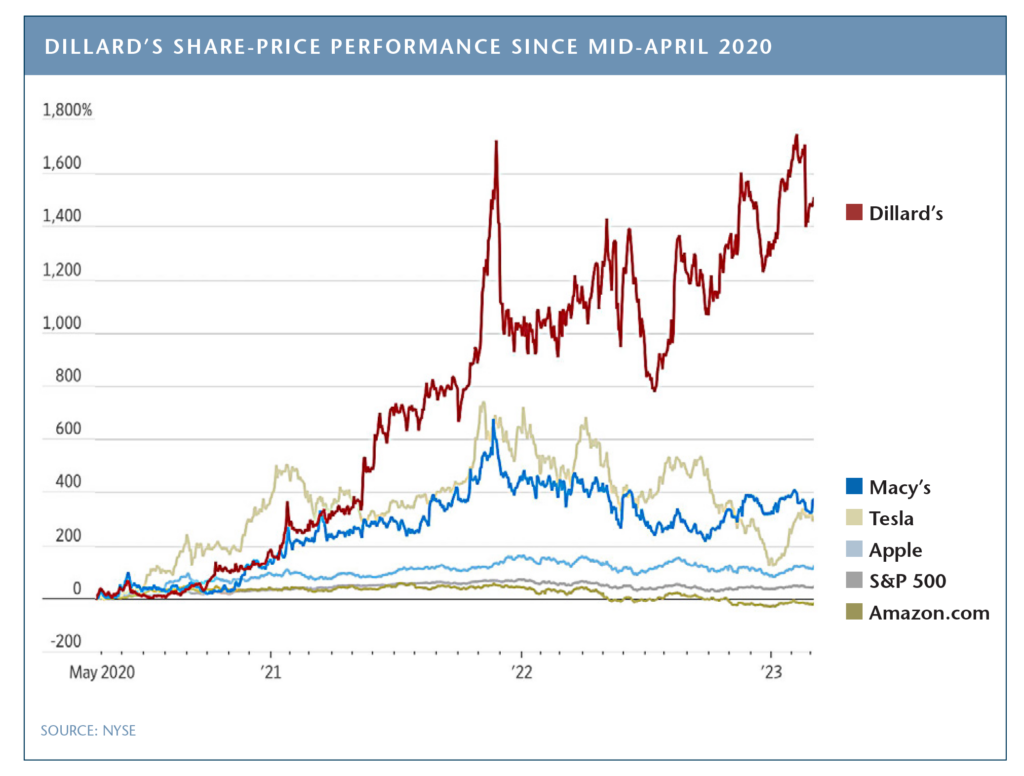

William was right. Dullards? Hardly. It’s a reminder that staying true to one’s values and playing the long game, just like the Dillard family did, often leads to success rather than failure. Some businesses (like Shopify) make those instant moves and instant money and have long-term success. Yes, it happens but it’s rare. In recent years Dillard’s has emerged as a true champion in not only retail but other categories as well – outshining the likes of Apple, Tesla, and Amazon in terms of share performance as displayed in this chart:

Dillard’s family-controlled business model

William Dillard founded his department store with a single $8,000 loan from his father in 1938. The company grew steadily over the years, eventually going public in 1969. Despite going public, the family retained voting control, with William serving as Chairman until his death in 2002. Since going public, the family remains focused on their values and has not lost control of playing the long game, much like the Rogers family and the Ford family. William’s five children and grandson (William III, the current CEO) continue to control the business, and other family members hold positions on the Board and in other key business areas.

What interests us the most is the common denominator among all three generations of Dillards – a deep commitment to William’s original values, including three shining examples of how the family played the long game well:

- A well-capitalized company with dry powder. If there’s one thing the Dillard family knows how to do, it’s playing the long game and capitalizing on taking advantage of opportunities using their financial resources to expand. Back in 1987, when Canadian company, Campeau Corp. needed cash to defray expenses, William Dillard seized an opportunity to expand its reach. For $225 million, they bought 27 Joske’s department stores and three Cain-Sloan department stores, giving them a monopoly in Texas and opening doors to the Houston market. But they didn’t stop there. Two years later, in a joint venture with The Edward J. DeBartolo Corporation, Dillard’s acquired the Higbee Company, a chain of 12 Ohio department and specialty stores, for $165 million. The move not only increased their physical presence but also showcased their willingness to adapt and diversify their portfolio. It’s clear that for the Dillard family, success isn’t just about the present but also about securing their future in the retail industry.

- Fiscal responsibility. Dillard’s ‘thrift mindset’ has been a value passed from generation to generation, playing a key role in the long-term success of its business. Thrift isn’t just a business value – it’s a way of life for the family. The Dillards believe in living within their means, avoiding excessive spending, and being good stewards of their resources. When you’re a retail maven like William Dillard, regional bankers sit up and take note. They were so impressed by his financial savvy and knack for turning businesses around that they practically threw an opportunity in his lap. That opportunity came in the form of the struggling Brown-Dunkin department store in Tulsa, Oklahoma, drowning in unpaid bills (kept in a cigar box). But William was unfazed by the challenges and took on the responsibility and paid those suppliers. He sold off some of his other stores, took out a loan, and launched an all-out newspaper campaign to turn things around. Despite union protests and naysayers galore, William’s efforts paid off: Brown-Dunkin was back in the black in no time.

- A lofty standard for retail excellence.The family has built a culture of extraordinary customer service, where customers are treated with respect and personalized attention. Stores are carefully curated, with attention to detail in every aspect, including the products offered and the store environment. The result is a loyal customer base with relationships that span multiple generations – like the owners of Dillard’s itself. In order to do this, they needed capital. William Dillard hit the stock market with a brilliant plan in 1969. He released two stocks, Class A and Class B. With Class A stocks, Dillard could make money and raise capital, while keeping control of Class B stocks. And guess what? His first public offering was a smash hit, selling 242,430 shares for $4 million on the American Stock Exchange. The perfect way to keep their lofty standards.

Now that’s how you play the long game.

The continuing success of family-controlled businesses

By prioritizing playing the long game, “sticking to their knitting” and instilling their values, the Dillards have seemingly done the impossible – managed to thrive in an industry many experts believe is dying ((total revenues exceeded US $7 billion as of January 2023). In an interview, a few years back, CEO William Dillard II, son of the founder, stated, “I don’t see department stores going away. There’s a role for us to play, and we’re going to play it well.”

The success of Dillard’s also reminds us that privately-controlled businesses – like Canadian families such as the McCains and Irvings and others here within our own borders – can be just as successful, if not more so, than their broadly held publicly traded counterparts. We’re particularly appreciative of the vital role business families play in driving the economies in which they operate. Family businesses, for example, employ over 60% of the U.S. workforce. Here in Canada, family-controlled businesses (many highlighted in CMG’s proprietary research study on Canada’s wealthiest families), employ more than six million Canadians, or roughly 47% of our country’s private-sector workforce.

It’s why we’ll always be interested in (and inspired by) families like the Dillards.

Further reading:

Here’s the Forbes profile in its entirety. It’s well worth the read.

Christina Outridge is a Marketing Communications Specialist at Creaghan McConnell Group.

Download and view the story as a PDF here.